When did selling protection get so complicated?

Forget comparing on price, most protection products now come with a host of additional benefits and frills (many unique to that provider) and it’s especially true in the income protection market.

It’s great for consumers seeking cover. Three-quarters of advisers say value-added benefits are important when recommending and selecting a product*. But the bad news? The protection landscape has become vast. More products have emerged with more features and more terminology. Consumers struggle to understand what Income Protection products have to offer, while advisers find it increasingly difficult to relay all the benefits of Income Protection to their clients**. The added complexity this brings to the advice process flies in the face of efforts to close the protection gap.

Something had to be done.

The demand for better product clarity

We wanted to understand what we could do to solve the problem and started by asking The Exchange users, ‘How could Iress help you better serve your clients’ protection needs?’ One answer came out top: product clarity.

The Exchange already automatically compares single against multi-benefit products on one screen, with the option to compare up to five protection benefits at once. But advisers want more clarity on additional features and to be kept up to date with what’s available.

12 features, one game-changing report

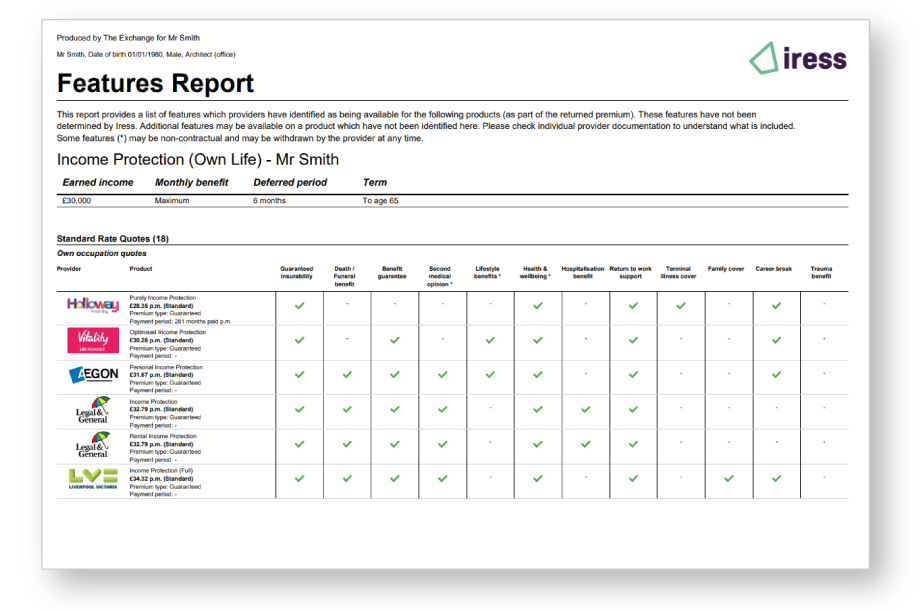

Armed with this insight, we developed an enhancement to the Income Protection service on The Exchange that brings clarity to the new protection products on the market; cutting through the emerging developments, additional features and provider-specific terminology.

It’s taken a coordinated effort from the whole industry but now, for the first time, advisers can compare a set of 12 additional benefits and product features in a single comparison report that also displays any specific commentary a product provider wants to highlight about their product features. Pretty neat, hey?

Starting valuable conversations

While other propositions may compare features based on rankings or ratings, our provider-endorsed features enhancement offers a transparent and accurate whole of market solution.

For advisers that means:

- Effortless complete whole-of-market research in one place

- Better, more informed conversations with clients

- Easier, more straightforward protection sales

For customers that means:

- Better understanding of their options

- Easier to get the best cover for their needs

- Confidence in their adviser and a positive financial experience

And for providers that means:

- Better awareness of their full income protection proposition

- Product information is always up to date and accurate

- Grow income protection sales

Some of the feedback so far:

It’s great to see Iress adding product features to their service, giving advisers a value focus in addition to the affordability and price information they already use with their clients.

Protection Specialist - Royal London Group

With this welcome development comes the hope that advisers can focus on demonstrating the real value of income protection to their clients and Iress are to be commended on their work in this area.

Co-Chair - Income Protection Task Force

This is just the beginning

The development comes at a time when more people are returning to the workplace, providing essential support for advisers wanting to take advantage of any uplift in protection enquiries.

It’s another vital step towards improving education, understanding and sales of income protection but only the start. The enhancement will be extended across our other protection services, bringing much-needed clarity across the whole protection market.

And it won’t stop there. Closing the protection gap is a long game but one we’re firmly committed to. Whether through our membership of the Income Protection Task Force (IPTF), or initiatives like our partnerships with CodePotato and Anorak, we’ll keep the conversation going and deliver the technology that makes it easier for everyone to get the protection cover they need.

*Iress multi-benefit survey 2021

Find out more

The new features enhancement is free for all Exchange users.

Talk to your Iress account manager or contact sourcing@iress.com to find out more.

You might also be interested in:

Iress Industry Voice - Protection issue

New thoughts and perspectives about 2021 shared, with articles from The Income Protection Taskforce, Legal & General, Vitality, Holloway Friendly, The Exeter, Aviva and Iress.

Let's talk about protection

How new industry initiatives aim to make the difficult conversation a little easier.

How to engage financial advice clients in 2021

Whether it’s delivering films, food or financial advice, technology gives us a simpler, more convenient way to access what we need. And the better the experience gets, the more we want to use it.