Roadmap to ESG series - Part five

Welcome to the fifth part of our roadmap to ESG series, compiled in collaboration with research firm NextWealth. This time, we look at how to start a conversation with clients about ESG so that you can get a better understanding of their attitudes and what’s important to them.

Opening up a conversation around ESG with clients requires careful thought and preparation to enable you to provide investment solutions that meet all client expectations.

Understanding what clients want when it comes to ESG

As we referenced in part one of the series, most financial advisers include a question about ESG in their Know Your Client process - just 6% did not in 2021, according to NextWealth research.

However, to really understand what clients want, it’s necessary to dig a bit deeper and having a well thought out questionnaire is a structured way to do this.

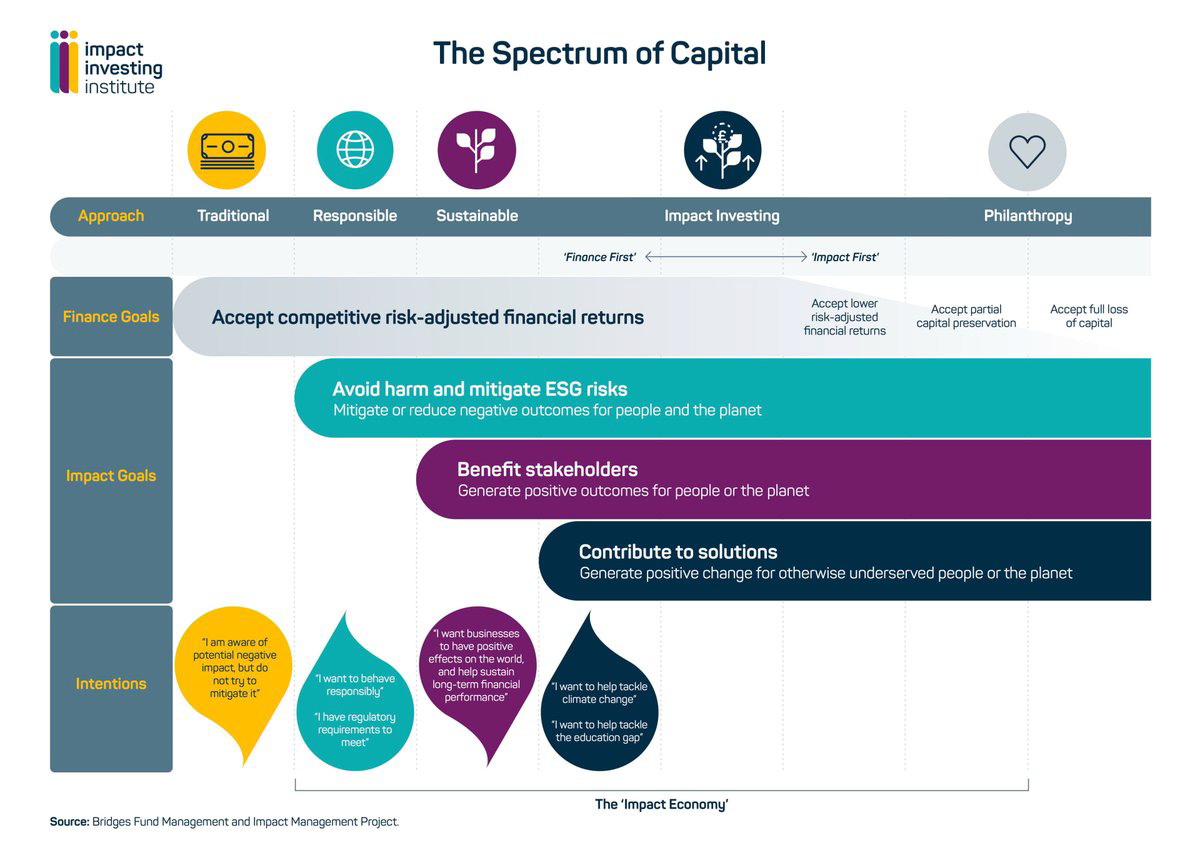

A number of advisers we spoke to have also used a spectrum such as this one from the Impact Investing Institute  , to help guide them with client conversations. Talking it through with clients can help both parties get a clearer idea of where the client currently sits in terms of their expectations.

, to help guide them with client conversations. Talking it through with clients can help both parties get a clearer idea of where the client currently sits in terms of their expectations.

“We use a document that we’ve called ‘understanding your values’ with clients. It asks clients for their hierarchy of wants in relation to ESG issues.”

Alison Masson, HFL Financial

Documenting the client’s position and objectives

Having a really good conversation with clients about their goals and objectives is already a fundamental part of financial planning for many businesses. Most clients will have broad goals around having a sustainable income to last until the end of their lives, and perhaps be able to pass on wealth to their children.

Building in a few good questions on responsible investing or talking clients through the Spectrum of Capital (see above) allows you to get a sense of their attitudes towards ESG and whether their needs are met by your existing investment proposition or whether they require a more specific solution.

A vital part of this process is documenting the client’s position and objectives. For example, if you establish where the client feels they sit on the Spectrum of Capital, that should be documented and saved.

Knowing the right questions to ask

The way you ask questions will have a direct impact on the direction the conversation takes. For example, if you start by asking “is there anything you wouldn’t want to invest in” you could find yourself presented by a list of things that is more difficult to manage within your firm’s ESG strategy. Animal testing, tobacco, oil, plastics, human rights – all have negative connotations on the face of it but it’s rarely that straightforward.

For example, pharmaceutical companies have a legal requirement to test on animals before testing cancer drugs on humans.

Starting the conversation with an exclusion question could open up a can of worms and lead to investment decisions being made that might not be in the best interests of the client overall.

“We try to stay away from ‘Is there anything you don't want to invest in?’ Because you can end up with a list of things that either isn't realistic, or the clients don't really mean it. If you start with that it just makes a rod for your own back.”

David Nelson, Intelligent Capital

Advice firms also need to address the balance between client preferences and avoiding narrowing the portfolio such that volatility and lack of diversification becomes a bigger risk. Some firms we spoke with use a ranking system to work out what is most important to clients.

“I think there is a distinct possibility of concentration risk, lack of diversification, potential returns that are not in keeping with the main market, potentially. We've got to look at all these things and decide how the client ranks them. Their ethical preferences and strong viewpoints on climate change might override all of it. But it might be a case of just saying, ‘Can you rank the importance of all these things?’, and then you can get a gauge on that, for example if returns, diversification, concentration, and all those kinds of things come out higher.”

Alex Reynolds, Advies Private Clients

Best practice

Some planning firms we spoke to leave it up to the individual planners to formulate their own questions to investigate clients’ preferences for ESG. Those that have a more structured process believe they get better outcomes for a number of reasons:

- The conversation has to be had – it’s part of the overall process.

- Such a process removes any bias the planner may have on the topic – some planners are ‘eco-warriors’, some are ambivalent and some regard it as less relevant than achieving stellar returns. A standardised approach to questions means the focus sits squarely with the clients.

- It helps with regulatory reporting.

“I don't think we've got a best practice yet, we have discussed between us various ways of doing it, including using much softer facts like who do you bank with? What type of car do you have? Who's your electricity with? There have been a few iterations and we’ve had to hone the questions.

You can elicit really bespoke responses. So we actually have to say, these are the options that we have available to us and describe the actual outcomes and say, what outcome would you be most comfortable without of these and then describe the possible outcomes as opposed to saying exactly “what do you not want”? Because then we end up going down a bespoke portfolio route that maybe the client doesn't have the funds for.

There's not one central way of having the conversation, although we do issue the same ‘Understanding your values’ document after the conversation, so if there's anything missed out in that original conversation, it's all within the document when it goes out to the client.”

Alison Masson, HFL Financial

All the advice professionals we spoke to underlined the importance of preparation. A few had learned the hard way, creating added complication to the investment process by asking the wrong type of questions.

Next time we look at how firms are evolving their ESG offering over time.

Roadmap to ESG part 6: Expansion and scale up

Continue your ESG journey by following us on LinkedIn for the next article and collect the full eight-part series. You'll also be among the first to be notified when our complete Roadmap to ESG guidebook is available.